In order to prevent financial crises like the current economic situation, corporate leaders need to better emphasize moral decisions, possibly by looking to religion, a panel told about 60 students Wednesday night.

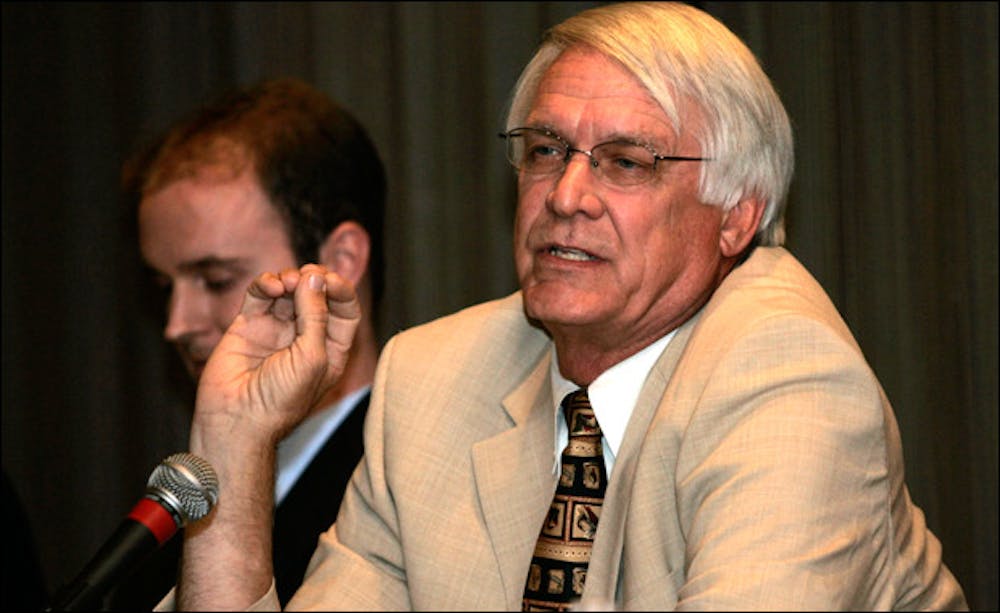

A corporate environment should have clearly defined boundaries between right and wrong — boundaries that were missing in the lead-up to the current financial crisis, said Stephen Happel, a professor of economics at the W.P. Carey School of Business.

“When you get to define morality, that is not morality; that is relativism,” Happel said. “Religion … defines morality in absolutes.”

The five-person panel, which included experts in business, law and ethics, was sponsored by Hillel at ASU, a Jewish student organization.

The panel was put on by the W.P. Carey School of Business and the Sandra Day O’Connor College of Law and moderated by Dale Kalika, a management faculty member.

Rabbi Barton Lee, executive director of Hillel at ASU, said religion must play a role in economic matters — especially because regulations will always have legal loopholes.

“We have to answer to a higher authority. Our acts need to be godly,” he said. “Religion can be, for many people, a moral grounding.”

Myles Lynk, the Peter Kiewit professor of law and the legal profession, said regulations cannot cover all ethical dilemmas.

“The law will tell you what’s possible, what’s permissible,” he said. “But it doesn’t necessarily tell you what’s preferable.”

The problem is regulators are not omniscient, so regulatory measure need to be made carefully, he said.

“We want the innovation, the growth, the stimulation that capital markets and a market economy bring,” he said. “But they have to go hand in hand … with effective and smart regulation.”

Lynk said there is an overly simplistic view of regulation where only two types exist: heavy regulatory practices that stabilize the economy but prevent it from moving quickly and less regulation, which allows markets to rapidly develop but possibly destabilize.

“That’s not necessarily an accurate dichotomy,” he said. “There’s also smart regulation, which can permit innovation but also helps to eliminate … crises.”

The reality of society is that greed is a driving force, Lynk said.

“Greed is a reality; … it does motivate certain behavior,” he said. “People want to maximize profits.”

Daniel Pennington, an accounting freshman who attended the panel discussion, said religion should play a role in corporate decision-making.

The U.S. was founded on Christian principles, Pennington said, and these ideals should apply to the private sector.

“For businesses to work in the United States, they have to have that religion guiding them,” he said. “Our nation was founded on Christianity.”

Reach the reporter at matt.culbertson@asu.edu.