With Bitcoin becoming more and more mainstream, it is important for ASU students to understand how virtual currency works.

Watching Bitcoin reach various peaks and valleys has been exciting for those with an interest in investing, but students need to understand what they are dealing with before making a purchase.

As of now, Bitcoin is the first glance at the extraordinary future of virtual currency. Students should understand the benefits of learning and investing in Bitcoin but also become aware of its risks.

Bitcoin may be an excellent way for students to make some extra cash to pay off student loans or buy groceries, but it is not stable enough to serve as an alternative to a job or a consistent form of investing.

College students are especially vulnerable to making bad decisions about Bitcoin. Students who are unaware of the risks that come with Bitcoin may invest too much money or even behave irresponsibly with purchases.

“Do the best you can to understand what you’re investing in," said ASU economics professor Cara McDaniel. "Invest at your own risk, but if you’re looking for long term investment opportunities, there are better avenues. Never risk your tuition money."

In simple terms, Bitcoin is a unique virtual currency backed by tangible currencies, like the US dollar or the Euro.

Bitcoin can be used to make purchases on mainstream websites, like Expedia and Overstock, but is also used to buy illegal items on the dark web. Since Bitcoin is virtually untraceable, many criminals seek to use cryptocurrency to mask their dark web purchases — such as drugs, illegal pornography and illicit weapons.

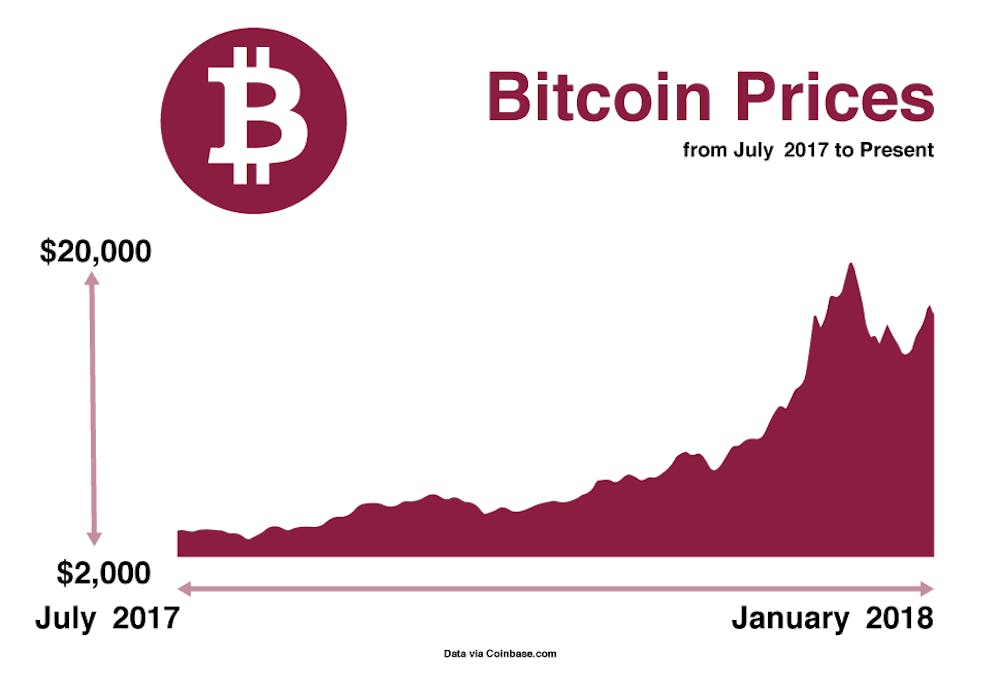

When people invest their own money into Bitcoin, the Bitcoin goes up in value. In 2017 alone, Bitcoin soared from just under $1,000 in value to almost $20,000.

Bitcoin is typically purchased through wallets, which are exactly what they sound like. A wallet allows users to store, purchase and sell Bitcoin. They are usually virtual, and contain the user’s private keys, allowing them to make purchases anonymously. One of the most user-friendly wallets for college students is Coinbase.

“It’s not an investment in the true sense in that it is not a productive asset, but people are using it for something that has value,” McDaniel said. “Sometimes you say the same thing about gold ... The only reason gold has value is because you buy it, hoping that someone will buy it for a higher price sometime in the future.”

Students should know that Bitcoin does not always increase, but often reaches serious lows. After reaching greater than $19,000, Bitcoin experienced a massive plunge, reaching below $10,000 on January 17th. This substantial decrease in profit proves how unstable Bitcoin can be, as well as that investors need to take precaution with their money.

It is important that students do not treat Bitcoin as a savings account. Nobody knows for certain how the market will react to bitcoin’s newfound fame, let alone who created Bitcoin in the first place. Mystique and volatility comes in a package deal with Bitcoin, and students should not use cryptocurrency as a primary bank account at the moment.

The future of Bitcoin is up for grabs, especially in 2018.

Reach the columnist at amsnyde6@asu.edu or follow @AnnieSnyder718 on Twitter.

Editor’s note: The opinions presented in this column are the author’s and do not imply any endorsement from The State Press or its editors. The author of this column has invested in Bitcoin, but is not a professional investment consultant.

Want to join the conversation? Send an email to opiniondesk.statepress@gmail.com. Keep letters under 500 words and be sure to include your university affiliation. Anonymity will not be granted.

Like The State Press on Facebook and follow @statepress on Twitter.

Continue supporting student journalism and

donate to The State Press today.